I have undergraduate and Master's degrees in History , and there was a time when I was really into memorizing as many quotes from respected historical figures as I could.

, and there was a time when I was really into memorizing as many quotes from respected historical figures as I could.

It became a problem.

While dropping a relevant quote from Churchill or Jefferson, on-demand and in context, was occasionally impressive, it became an affectation – like smoking a pipe, wearing a pocketwatch, or growing out one of those ridiculous beards Millinneals living in hipster neighborhoods wear.

But one of the quotes that has always stuck with me was this:

For those whose video players don't work or are slow to load, it's a quote from JFK where he says:

"…The definition of happiness… is full use of your powers along lines of excellence."

I would argue that "success" is defined similarly, and as the new year approaches and we all are in the process of planning for the coming year, I think these are valuable observations we should all resolve to emulate.

A singular industry

Over the course of the past 7 years or so, I’ve come to meet (if not work with) some of the most intelligent, thoughtful people imaginable. But more than that, I’ve been struck by the diversity of impulses that motivate them day-to-day.

And, given the stereotype, I’ve been surprised by just how few seem purely driven by the extrinsic rewards of the industry. Perhaps that’s just naiveté on my part; maybe if you’re in investment management, money is what drives everyone, so nothing really need be said about it.

But I don’t think so. It seems as though it's the challenge and the base competitiveness of the industry that lie at the root of what drives most of the successful people I’ve met.

The industry's raison d’etre

I think the wellspring for that competitiveness is embedded in the base argument for why investment management exists, and is summed up in the following elevator pitch:

“Picking investments and managing a portfolio are a full time job, requiring specialized knowledge and a singular focus. Sure, you can do it yourself, but not nearly as well as we can. Outsource the responsibility to us. We will take care of you.”

This has the benefit of being both true and self-serving, and so the question becomes: who can take care of clients better? That's where the competition lies.

Those who give advice are usually the last ones to take it

But despite the centrality of the outsourcing argument to the industry, as well as the aforementioned thoughtfulness and intelligence of its practitioners, I've always found it surprising that so few investment managers fully heed its admonitions in areas of their own business.

I specialize in digital investment management marketing, content creation, distribution, and analysis, so I’ve seen more than my fair share of incomprehensibly bad websites, read enough jargony, buzzword salad-y pitchbooks, and reviewed enough eVestment profiles with flat-to-declining AUM over a number of years to know that there is a definite bell curve in investment management marketing.

There are a few firms that knock their marketing out of the park, a few that whiff completely, and a whole lot of in between. I’d like to focus on the "in between," because that’s probably where you are.

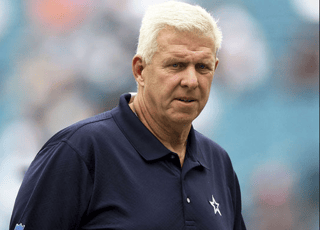

There’s an old quote from football coach Bill Parcells that’s relevant here:

“You are what your record says you are.”

Unless you have a steadily growing client base (and have yet to reach your capacity constraints), your marketing and sales effort are underperforming. But figuring out what to do is a common problem in investment management marketing for a simple reason: firms are owned and operated by investors, not marketers, by and large.

As such, the firm's resources are earmarked primarily for the PROCESS and the RESEARCH and other investment-specific initiatives.

Attention to the marketing function ebbs and flows. Marketing is, to its detriment, often viewed (at best) as a series of campaigns or (at worst) isolated instances of disconnected outreach.

Either way, neither represent what investment management marketing should be: a perpetual, relentless business function.

So what to do?

Focus on your strengths and find trusted partners to do the rest

Portfolio managers and CEOs, as much as you trust your own education and experience to guide your investment decisions, recognize that your sales and marketing people have the same capabilities in their niche.

If you are willing to acknowledge that their niche is not yours, it makes it easier for you to do the right thing and trust your marketing people next year.

So, how can you demonstrate that trust?

- Experiment with giving your director of sales and marketing/business development/[insert euphemism here] with the all the resources (including time) they say they need;

- Allow them to develop a long-term 12-24 month marketing and sales strategy;

- Open up the corporate checkbook; and

- Be patient. If your portfolio management process allows you to look at an investment as a 18-24 month proposition, then make the same commitment to your marketing team's plan. Effective marketing is a long-term proposition.

Expending resources on developing a new model, purchasing an upgraded piece of software, or some sort of practice management service will likely only make an incremental difference in your operations.

But investing that money in your marketing team will yield significantly enhanced results over the intermediate- to-long term. Marketing more than pays for itself over time.

So be patient, put aside your reservations, and let those you hired to do your marketing perform their job at a high level and to the best of their ability.

Then, you can go back to focusing on picking investments, tweaking your models, and managing client accounts - you know, do the stuff you're good at and enjoy - knowing that you've taken concrete steps towards solidifying your firm's future viability.

So, Resolution #2 for 2017 is: Trust your marketing people.

They won't let you down.